We'll Help You Buy Your Dream Home

The Home Buying Journey

Buying a new home is an exciting milestone in many people's lives but can sometimes be a little overwhelming. From securing your a home mortgage, to negotiating an offer and closing, there are a lot of moving pieces that can leave you stressed and confused. When you work with us we will guide you through every step of the buying process, offering sound advice along the way.

By working with a REALTOR® you can trust, who knows the ins and outs of the real estate industry, you’ll not only end up with your dream home, but you’ll also walk away with a great experience.

The Step by Step Buying Process

1. Getting pre-approved by a lender

By providing your Real Estate agent with some basic information about your income, savings, and debt, he or she can assist you in getting pre-approved by a reputable mortgage lender. The lender will then go over various financing options available to you, what monthly payment amount you can afford, and what you can expect for down payment requirements and closing costs.

2. Choosing a home

For most buyers, choosing a home is an emotional process. A trusted Real Estate agent can assist you in this process by offering objective information about each property you look at. From local community information like schools and zoning to home-specific details like condition and amenities, an agent can help you find exactly what you’re looking for.

3. Making an offer

Once you’ve found the home of your dreams, a Real Estate agent will research recent comparable sales of similar homes in the area to help determine a fair selling price. Based on those comparable sales, as well as other factors like inspections and repairs, an agent will then help you structure an offer and negotiate to get you the very best deal possible.

4. Closing

Closing, or settlement, can be a complicated process. In some areas, the escrow or title company handles the closing process, while in other areas an attorney handles it. Regardless of where you’re buying, a Real Estate agent can help ensure that closing process goes smoothly.

Get Pre-Approved

Before you start looking for your new dream home, it’s a good idea to meet with your Mortgage Lender to get pre-approved for financing. At this stage, they will gather information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so we will help you get pre-qualification for the specific programs that best suit your needs.

Start Your Home Search

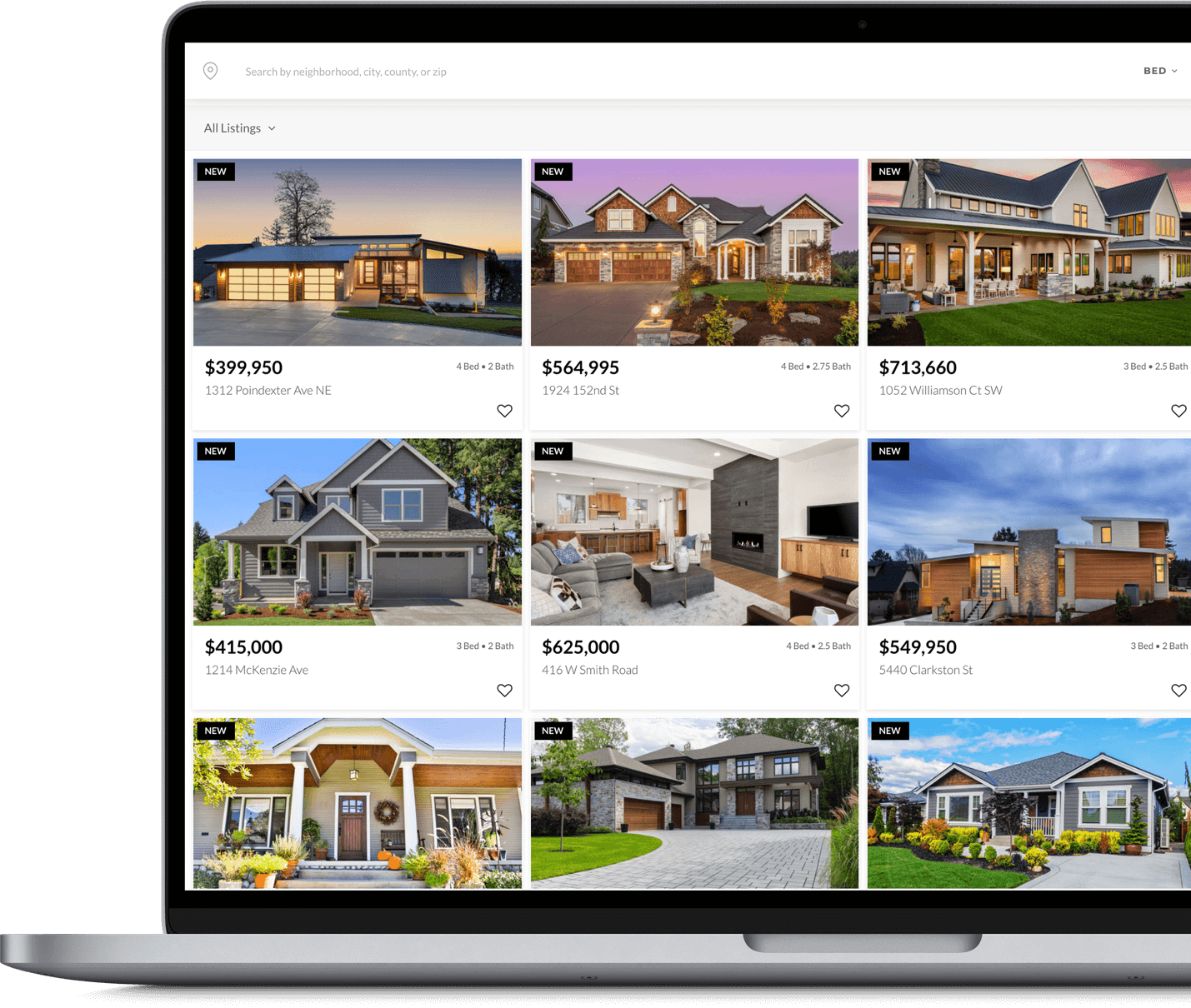

Search for homes wherever you are

When buying a home, start by making a wish list and setting a budget. We can help you choose a lender so you can be pre-approved for a loan, and then you're ready to start searching for the perfect property. You can search for homes using my website from any device including your computer, laptop, tablet, or smartphone.

Start Searching

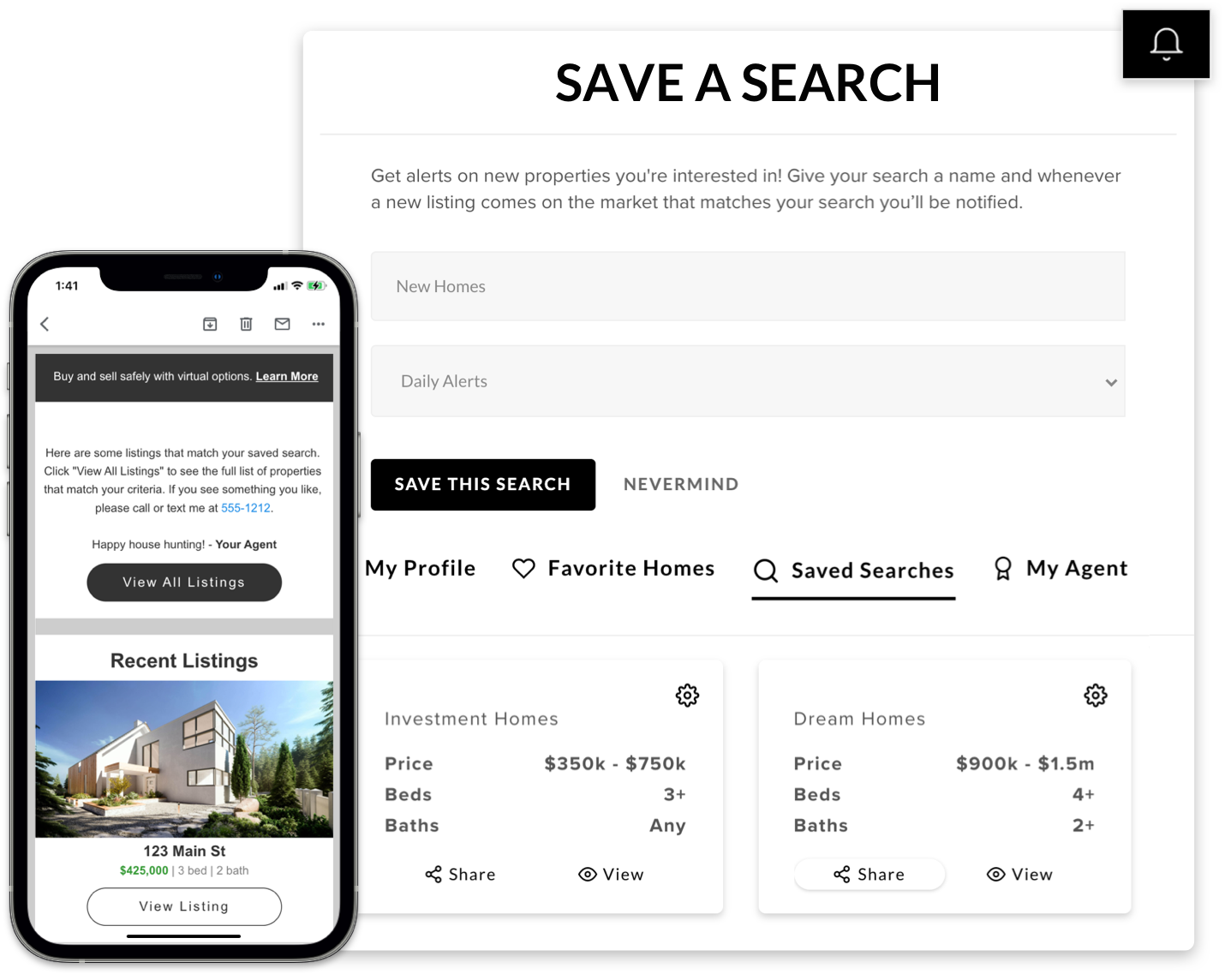

Get Free Listing Alerts

Be the first to know when a property hits the market

When you save a search on our site, any new homes matching your wish list criteria will be delivered straight to your inbox the moment they go up for sale.

Save and See Listings

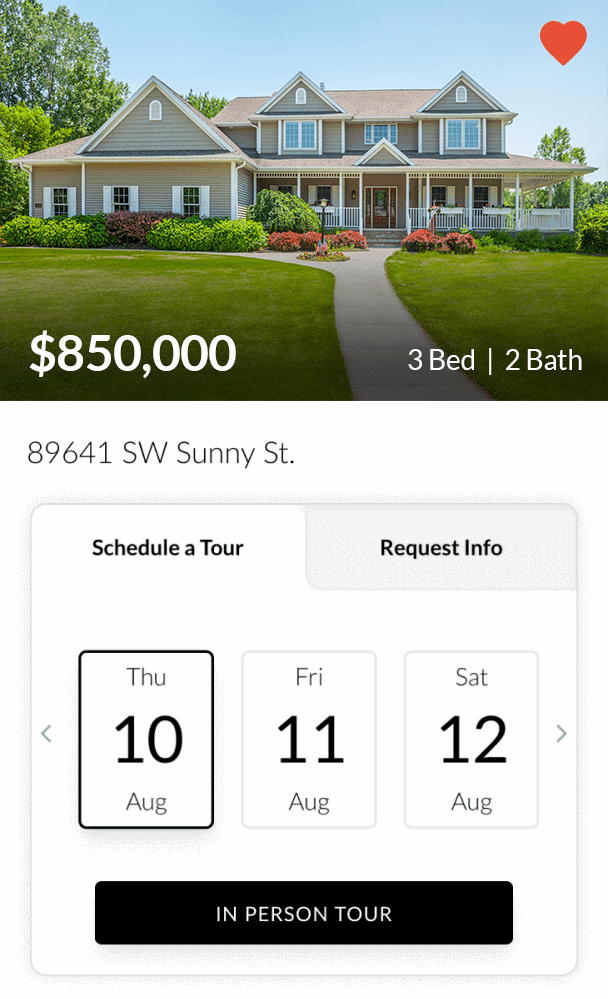

Favorite properties and tour homes

Click the icon when you find a house you love to save it in your favorites section and let us know you like it. Hit "See This Listing" or reach out to your agent directly to schedule an in-person showing. We're happy to walk you through the home and answer any questions, so you can make an informed decision.

Making An Offer And Closing

We're With You Till The End

When you find a home you love, your agent will help you submit an offer. We are skilled negotiators that know how to get you the best price and value possible. Once an offer has been accepted we'll help you navigate through inspections, appraisals, and closing in a stress free way. We do all of this at no cost to you, the buyer, as we are compensated by the sellers.

Then it's time to get the keys, throw a housewarming party, and make lasting memories in your new home. We're so happy that you trusted us to help you through this exciting process.