Before You Buy

4 Questions To Ask Before You Buy

Whether you’re a first-time homebuyer or a seasoned real estate investor, buying a home is a very exciting process. However, there’s also a lot to consider when you decide to purchase. So before you begin your search for the perfect home, here are four questions you should ask yourself.

1. What do I want?

Taking the time to figure out what type of property you want to buy is a very important first step. From single-family to multi-family homes and condos, there are several home options on the market and it’s important to choose the type that best fits your needs. Figuring out the town or neighborhood you want to live in is equally important. While a new home might have all of the upgrades and amenities you’re looking for, factors like school districts, shopping, crime rate and proximity to highways can impact the overall home-owning experience. A good process to follow is to list out and prioritize your needs (e.g. area, number of bedrooms and bathrooms, square footage, large backyard, great school system) before you begin your search.

2. What can I afford?

The rule of thumb of what you can afford is that you should never spend more than 30% of your monthly income on a mortgage payment. An alternate rule states that you can afford to buy a property that runs about two-and-a-half times your annual salary. To get a better picture of what you might be able to afford, use an online mortgage calculator to see what your monthly mortgage payments would be like if you bought a home today with current interest rates. If you would like a detailed view contact us today so we can connect you with our home mortgage professionals.

3. Am I financially prepared?

A few months before you start searching for a new home, you should pull a free credit report and review your credit history to make sure it's in good standing. When you get copies of your credit report, make sure that it’s accurate, look for strange activity and fix any issues you discover. It’s likely that you’ll also want to get pre-approved for a home loan, which will put you in a better position to make a serious offer once you find the right home. Pre-approval from a lender is based on your credit history, debt, and income.

4. How do I make the best bid possible?

Do your research and work with a Real Estate agent! Your first offer should be based on the sales trends of similar homes currently for sale and sold in the area within the last six months. A good Real Estate agent will pull the data for you and will review the selling prices of comparable properties. If these properties sold for less than the current asking price of the home you’re looking at, you can feel comfortable making an offer that’s slightly lower than what the seller's asking price.

Ready To Start Your Home Search

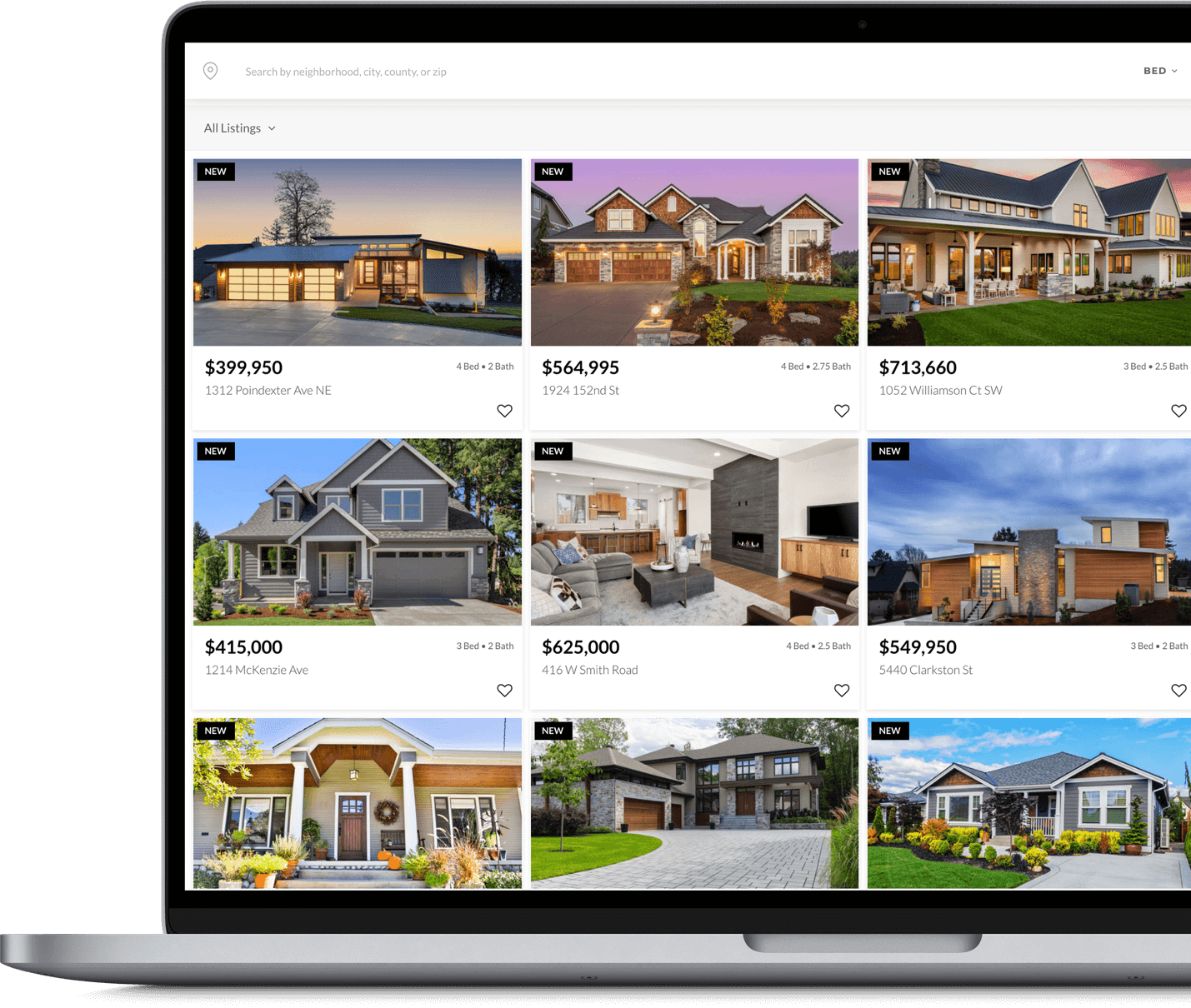

Search for homes wherever you are

When buying a home, start by making a wish list and setting a budget. We can help you choose a lender so you can be pre-approved for a loan, and then you're ready to start searching for the perfect property. You can search for homes using my website from any device including your computer, laptop, tablet, or smartphone.

Start Searching